mississippi income tax rate 2021

House Bill 1439 the Mississippi Tax Freedom Act of 2021 quietly emerged Monday and was passed by the Ways and Means Committee late. How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table.

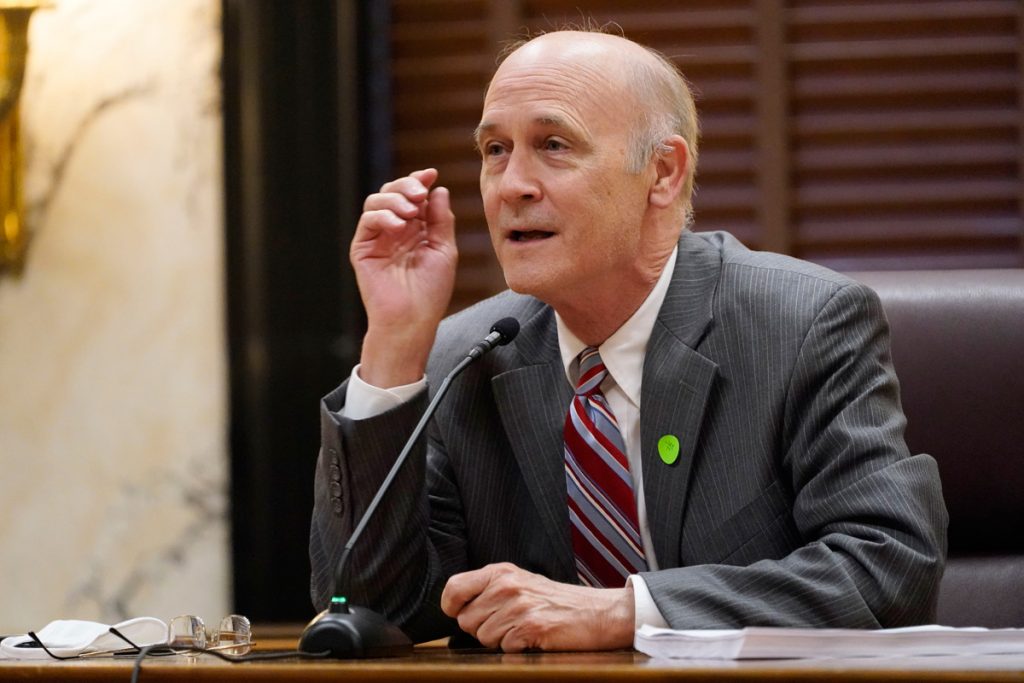

Mississippi Senate Passes Income Tax Cut Slashing 446 Million

For an in-depth comparison try using our federal and state income tax calculator.

. These rates are subject to change. Your 2021 Tax Bracket to See Whats Been Adjusted. Mississippi sales tax rates.

2019 Mississippi State Tax Tables. Any income over 10000 would be taxes at the highest rate of 5. Find your income exemptions.

2020 Mississippi State Tax Tables. Read the Mississippi income tax tables for Single filers published inside the Form 80-105 Instructions booklet for more information. 2021 and data from the Tax Foundation.

0 on the first 2000 of taxable income 3 on the next 3000 of taxable income 4 on the next 5000 of taxable income 5 on all taxable income over 10000. Ad e-File Free Directly to the IRS. Gunns proposal would phase out the personal income tax in waves beginning with single filers earning 40000 or less per year.

Tax Rates Exemptions Deductions. Mississippi Tax Brackets for Tax Year 2021 As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The Mississippi tax rate and tax brackets are unchanged from last year.

Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1. Mississippi State Tax Calculator 2022. Check the 2021 Mississippi state tax rate and the rules to calculate state income tax.

Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Ad Compare Your 2022 Tax Bracket vs. 0 percent on income up to 3000.

In tax year 2022 the 3 percent rate is scheduled to be repealed leaving the 4 percent rate on marginal income exceeding 5000 and the 5 percent rate on marginal income exceeding 10000. Wages are taxed at normal rates and your marginal state tax rate is 00. Senate kills Mississippi income tax elimination.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Medical marijuana and taxes the hallmark 2021 legislative efforts are likely dead.

Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. Mississippi State Tax Quick Facts. By Bobby Harrison March 22 2021.

The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. 4 on the next 5000 of taxable income. 2021 Mississippi State Sales Tax Rates The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Your 2021 Tax Bracket to See Whats Been Adjusted. Mississippi sales tax rates. It would totally phase out the states personal income tax over a 10-year period if.

Taxable and Deductible Items. Our calculator has been specially developed. Your average tax rate is 1198 and your marginal tax rate.

Mississippi taxes income at rates of 0 percent 3 percent 4 percent and 5 percent as of 2021. Discover Helpful Information and Resources on Taxes From AARP. By Geoff Pender March 16 2021.

Find your gross income. Mississippi also has a 400 to 500 percent corporate income tax rate. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

The legislation contains language that the plan will be examined by 2026 with an eye toward. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes.

Mississippi residents have to pay a sales tax on goods and services. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. Starting in 2022 only the 4 percent and 5 percent rates will remain with the first 5000 of income exempt from taxation up from 3000.

Mississippi State Personal Income Tax Rates and Thresholds in 2022. 3 percent of income from 3001 to 5000. House tries to revive it.

Mississippi has a graduated tax rate. 2018 Mississippi State Tax Tables. Mississippi Income Tax Calculator 2021.

Roby said poor Mississippians would face an increased tax burden under the proposed plan which eliminates personal income tax and raises the state sales tax 25. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Find your pretax deductions including 401K flexible account contributions.

In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt. 0 on the first. Calculations are estimates based on tax rates as of Dec.

California Income Tax Calculator 2021. Phase out the 4 state income tax bracket over four years. 16 hours agoMoving to a flat four percent income tax puts.

The bill would immediately eliminate the personal income tax for individuals making under 50000 a year and for married couples making less than 100000. Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket. Detailed Mississippi state income tax rates and brackets are available on this page.

As it stands now personal. Married couples making 80000 would also be exempt from state. 2021 Mississippi State Tax Tables.

The graduated income tax rate is. Note that for tax year 2021 the first 4000 in taxable income is not taxed. Mississippis sales tax rate.

Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020. Mississippi State Tax and Salary Calculators. 079 average effective rate.

Mississippi Salary Tax Calculator for the Tax Year 202223.

Tax Rates Exemptions Deductions Dor

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Income Tax Brackets 2020

Mississippi Tax Collections Continue To Soar Mississippi Today

Mississippi Income Tax Calculator Smartasset

York Maine States Preparedness

Mississippi Tax Rate H R Block

Mississippi State Tax H R Block

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mississippi Sales Tax Small Business Guide Truic

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi News Us News

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi Income Tax Calculator Smartasset

Tax Rates Exemptions Deductions Dor

Mapsontheweb Infographic Map Map Sales Tax

Where S My Mississippi State Tax Refund Taxact Blog

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics